Articles

Mideast Turmoil Hits Saudi Aramco

By: G. Cook Jordan, Jr. and Lori A. Callaway

Oil giant Saudi Aramco (Aramco) launched the world’s largest initial public offering (IPO) on December 11, 2019. The Saudi government sold 1.5% of its stake in the state-owned company raising $25.6 billion. The company, considered the most profitable in the world, was valued at $1.8 trillion. The initial public offering provided much-needed funds for Crown Prince Muhammad bin Salman’s plan to reform the Saudi Arabian economy to make it more competitive in the global economy and less dependent on oil revenues.

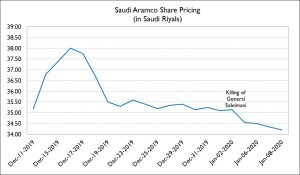

The company’s market value has fallen by $200 billion since its mid-December peak, and the stock’s downtrend is accelerating in the wake of heightened tensions between the U.S. and Iran. The company’s shares have dropped despite a surge in crude oil prices of as much as 6% to near $70 per barrel, which suggests that rising oil prices aren’t necessarily a boost for the energy giant.

As of January 8, shares of Aramco have fallen 10% from their peak on December 16, a few days after they began trading on Saudi Arabia’s Tadawul exchange. Over the same period, BP PLC has gained 5.6%, Royal Dutch Shell PLC (U.K.-listed Class B shares) climbed 6% and ExxonMobil shares have fallen 1.1%.

Aramco shares have dropped further since the January 2nd killing of Iran’s most prominent general, Quds Force commander Qassem Soleimani, by the United States. On January 8th, Aramco fell 0.4% to close at 34.20 Saudi riyals, or about $9.12, a share. At that level, Aramco shares are down 2.8% from where they closed on their first day of trading on December 11th, but still 6.9% above the IPO price of 32 riyals (or $8.53).

The attack on General Soleimani is a reminder of the risks of investing in the region. Investors are worried that Iran, one of Saudi Arabia’s regional foes, could target Aramco’s production facilities or its computer networks. In September of last year, the company’s oil production was cut in half after explosive-armed drones struck some of its most important production facilities. The U.S. and Saudi Arabia suspect Iran of launching the attack. A month after the attack, Aramco was able to resume its normal production level of 9.9 million barrels per day.

Iran has strong cyber capabilities and it has previously been linked to attacks on major banks like JPMorgan Chase, Bank of America and Wells Fargo. In 2012, Aramco suffered one of the worst cyberattacks when 35,000 of its computers were partially wiped or totally destroyed by hackers.

Aramco’s stock price depends on continued support from local and regional investors, as most of the investors who participated in the $25.6 billion IPO were Saudi Arabian individuals, companies and institutions, along with the funds of neighboring Gulf Arab monarchies. Saudi Arabian government institutions invested about $2.3 billion in the IPO.

Through its IPO and the company’s numerous business ventures, Aramco is a national oil company that wants to become a global energy company. Much of the company’s expansion plans focus on developing countries in Asia, where demand for oil is likely to grow in the coming years. The U.S. is also a target for growth especially in the areas of refining, petrochemicals and liquefied natural gas. Aramco already owns the largest oil refinery in the U.S., the Motiva Enterprises plant in Port Arthur, Texas. It also has research centers and technology offices in Boston and Houston, as well as an office in New York that organizes scheduling, storage and transportation of crude oil in the U.S. and Canada.

Despite its recent drop, Aramco remains the world’s most valuable listed company with a valuation of $1.8 trillion. The second-most valuable listed company, Apple Inc., is worth about $1.3 trillion. Aramco earned $111 billion in 2018 while producing 13.6 million barrels of oil per day. Its reserves are five times larger than its rivals – ExxonMobil, Chevron, Shell, Total and BP – combined.

Flare-ups of tension in the Middle East tend to benefit energy stocks because they generally boost the price of oil. However, Aramco is more exposed to the U.S.-Iran conflict than its peers around the world due to the concentration of infrastructure within the reach of Iran’s military capabilities. The prospect of a wider conflict between Iran and the U.S./Saudi Arabia jeopardizes Aramco oil exports and also risks driving away the overseas investors Saudi Arabia needs to provide fresh capital and diversify its economy.

Sources

- The Wall Street Journal, “Saudi Aramco shares take hit from Mideast conflict,” January 8, 2020.

- CNN, “Saudi Aramco has lost $200 billion in value since its post-IPO peak. Iran fears aren’t helping,” January 6, 2020.

- Bloomberg, “Saudi Aramco faces tough test less than a month after IPO,” January 6, 2020.

- Business Insider, “Saudi Aramco has seen $200 billion of market value erased since its record-shattering IPO as Mideast tensions drag it lower,” January 6, 2020.

- PBS News Hour, “What Americans should know about Saudi Aramco’s IPO,” December 11, 2019.

- MarketWatch, “The most important thing to know about the Saudi Aramco IPO,” December 9, 2019.

- The Wall Street Journal, “Saudi Arabia seeks to ease tensions with Iran,” December 12, 2019.