Articles

Russia and Saudi Arabia Start Oil Price War

By: G. Cook Jordan, Jr. and Lori A. Callaway

Oil prices recorded their biggest one-day crash since the Gulf War of 1991 on March 9th. Saudi Arabia, the world’s top oil exporter, aggressively cut most of its official selling prices by the most in at least 20 years and threatened to increase production to record levels, while Russia’s largest oil producer said it will ramp up production in April. On March 9th, Brent crude fell 24% to $34.36 per barrel. The price has continued to fall since then reaching $30.67 on March 19th. The fall puts oil prices at their lowest level in four years and about 55% below a peak on January 6th.

Oil prices had been falling for much of the year before the crash on March 9th due to a demand shock from the coronavirus’ effect on global travel, industrial activity and overall economic growth, in combination with the warmest winter on record in the Northern Hemisphere. Global oil demand is expected to be down 2.5 million barrels a day in the first quarter of 2020, with China accounting for 1.8 million barrels of that drop according to the International Energy Association (IEA). The IEA is forecasting that global oil demand will fall this year for the first time since 2009, contracting by 90,000 barrels per day. JPMorgan Chase expects Brent crude oil prices to average $27 a barrel and U.S. West Texas Intermediate oil to trade at $24 per barrel in the second quarter of this year.

In 2017, Saudi Arabia and OPEC joined with Russia to limit oil supply and prop up prices. The alliance held up until now. In meetings on March 5th and 6th in Vienna, Saudi Arabia recommended additional oil production cuts of 1.5 million barrels per day starting in April due to falling demand from China, extending until the end of the year. But Russia rejected the additional cuts. As a result, the OPEC+ (the extended 24-member alliance that includes Russia) agreement forged in 2017 will end in April.

Saudi Arabia announced plans to increase its daily production to 12.3 million barrels per day in April compared to about 9.7 million barrels per day in February. Saudi Arabia’s aggressive price cuts targeted some of Russia’s core markets in China and Northern Europe. Russia said it can increase its production by 200,000 to 300,000 barrels per day in the short term and 500,000 barrels per day in the long term. Thus, oil prices are falling as both Saudi Arabia and Russia are poised to flood the market with cheap crude oil in all-out price war just as the coronavirus is spurring contraction in demand.

The conflict stems in part from Russian and Saudi Arabian concerns over the U.S. shale industry, which in recent years has upended global energy markets and made America self-sufficient in oil. U.S. shale production has continued to increase steadily in recent years. Domestic output rose to a record 13.1 million barrels per day during the week ended February 29th according to the U.S. Energy Information Administration.

By lowering prices, Saudi Arabia hopes to undermine U.S. shale producers, as well as to destabilize their archrival Iran. In addition, this could be a move by Crown Prince Mohammed to assert his influence over the Kingdom’s oil policies and raise his international standing.

Low oil prices mean Saudi Arabia has to borrow to balance its budget and makes it difficult for Crown Prince Mohammad to carry out his expensive economic transformation plans in Saudi Arabia, including a new $500 billion high tech city in the desert. According to Saudi Arabian officials, the country needs oil prices over $60 per barrel to balance its budget.

The initial public offering in December of Saudi Arabia’s national oil company, Aramco, brought in cash to help fund the Prince’s plans, but low oil prices make its shares less attractive. Aramco shares are now valued less than they were at the offering. Foreign investors could be very hesitant to invest in the company if its operations (including production and prices) are dictated by the Saudi Royal Palace. The company’s initial public offering was the world’s largest raising $25.6 billion and valuing the company at about $1.7 trillion.

Moscow is fighting an oil market war on two fronts, with Saudi Arabia and U.S. shale. Moscow may be hoping to force American shale producers out of the market by lowering prices, or may be trying to take a bigger slice of the Asian market from Saudi Arabia.

As it became less reliant on global oil imports, the U.S. became increasingly bold in its use of sanctions against other nations. Moscow grew concerned when the U.S. started to focus its energy sanctions on Russia. In December, the U.S. announced restrictions on the $10.5 billion pipeline which is set to deliver more Russian gas to Germany. Part of Russia’s decision may also be a response to fresh U.S. sanctions on Venezuela, where Russia’s Rosneft oil corporation is helping finance state oil producer PDVSA.

Russia is better prepared to withstand low oil prices as oil now accounts for less than a third of its budget revenue and the country has accumulated massive reserves. Russia believes it could withstand 10 years of oil prices at $25 to $30 per barrel.

Oil prices have suffered massive drops each time Saudi Arabia has launched a price war to drive competitors out of the market. West Texas Intermediate crude oil fell 66% from late 1985 to March 1986 when Saudi Arabia pumped at will amid a resurgence of U.S. oil output.

However, this strategy has backfired before. In 2014, OPEC began to pump oil at will to compete with U.S. shale producers. The cartel believed that their ability to produce at extremely low prices would force U.S. producers out of the market. But after the price of crude fell below $28 a barrel in 2016, OPEC and Russia agreed to cut production in the first OPEC+ deal. Within months, oil prices more than doubled.

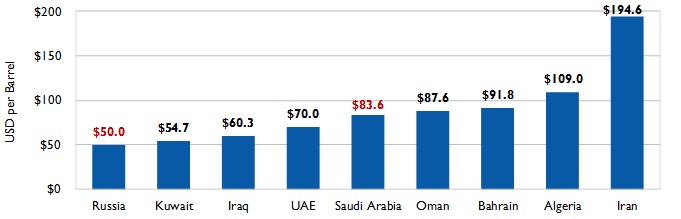

Lower oil prices will be a problem for the world’s main oil exporting countries, but some will be more affected than others. Shown below are oil prices required by each country in order to balance their national budgets.

Oil Exporters’ Breakeven Oil Prices, 2020 Projections (USD per Barrel)

Source: The Eurasia Group.

Russia and Saudi Arabia held talks in February that focused on possibly forging a broader long term alliance in which Saudi Arabia would speed up its investments inside of Russia where sanctions have hit the country and back its military efforts in Syria. They will meet again in June at the next scheduled OPEC+ meeting or they could possibly meet sooner by calling a special meeting in order to address the price war.

The recent oil market manipulations by foreign states reinforces the importance of the role of the U.S. as a reliable energy source to itself, its partners and allies around the world.

Sources:

Bloomberg, Oil Slammed by Price War and Virus in Worst Loss Since 1991, March 8, 2020.

The Wall Street Journal, Oil Prices Collapse After Saudi Pledge to Boost Output, March 9, 2020.

The Wall Street Journal, Inside Saudi Arabia’s Decision to Launch an Oil-Price War, March 10, 2020.

The Eurasia Group, Oil Exporters — Broken or Breaking Even?, March 10, 2020.

The Wall Street Journal, Saudi Arabia’s Crown Prince Tanked Oil Markets. Here’s the Back Story, March 11, 2020.

Newsweek, Saudi Arabia-Russia Oil Price War Explained: How Long Will it Last and Who is Likely to Win?, March 13, 2020.

The Wall Street Journal, Russia Takes Aim at U.S. Shale Oil Producers, March 13, 2020.

Pumps & Systems, Apocalypse Not?, March 16, 2020.

The Wall Street Journal, U.S. Oil Ends Below $30 as Energy Rout Continues, March 16, 2020.

CNBC, Oil Prices Could Hit Teens in Coming Weeks as Markets Crater Over Coronavirus and Price War, March 17, 2020.

The Wall Street Journal, U.S. Considers Intervention in Saudi-Russia Oil Standoff, March 19, 2020.