Articles

The Decline of Just-In-Time

By: G. Cook Jordan, Jr. and Lori A. Callaway

As a means of improving efficiency and lowering costs, most companies rely on a just-in-time (JIT) supply chain model, where materials are ordered and then delivered when they are needed rather than being stockpiled in excess. This inventory and production management system, developed by Toyota Corporation in the early 1970s, allows companies to reduce inventory damage and waste, decrease warehouse holding costs, and optimize production.1 It eliminates the need for each stage in the production process to hold buffer stock, which results in savings.

While the JIT model has served thousands of businesses well over the years, running a business this way is a precarious act of coordination. The previously thriving model is now struggling due to supply chain disruptions caused by the ongoing effects of the pandemic and sanctions on Russia. Transportation bottlenecks, raw material supply shortages, finished goods shortages, as well as inventory challenges, have adversely affected the global marketplace. For businesses, especially manufacturers, the supply chain disruptions have had financial and operational consequences. When raw materials and packaging are not available when needed, production is slowed or halted, and sales are delayed or lost altogether.

Global supply chains as a whole are still facing many logistical issues – labor shortages and increasing labor costs, port delays and a scarcity of shipping containers, reflected in the 500% surge in the price of shipping containers from Asia to the United States compared to last year.2 The moves in the Global Supply Chain Pressure Index from the beginning of 2022 suggest that although global supply chain pressures have been decreasing, they remain at historically high levels.3

Global Supply Chain Pressure Index3

Standard Deviations from Average Value

Within the energy sector, these logistical issues have exploited the weaknesses of the JIT model directly affecting the supply of energy, but also creating delays in the production and shipment of many materials and equipment crucial in the industry’s supply chain. With the United States banning the import of Russian oil and natural gas, the country is now pressured to produce its own. However, increasing domestic production has proven to be an issue as many exploration and production firms within the oil and natural gas industry are waiting much longer to receive materials and equipment they need such as casing and coiled tubing.4 In addition, producers and service companies are constrained by labor shortages. An industry that lacks materials and experienced staff cannot substantially increase drilling and production in a short period of time.

According to a recent Federal Reserve Bank of Dallas Energy Survey, the Supplier Delivery Time Index for the oil and gas sector rose from 30.6 to 31.9 in the second quarter – a record high indicative of the increase in the time it takes for firms to receive materials and equipment.5 The measure of lag time for deliveries among oilfield service firms also saw a record high, rising from 25.5 to 36.0, signifying delays in the acquisition of products/services.5

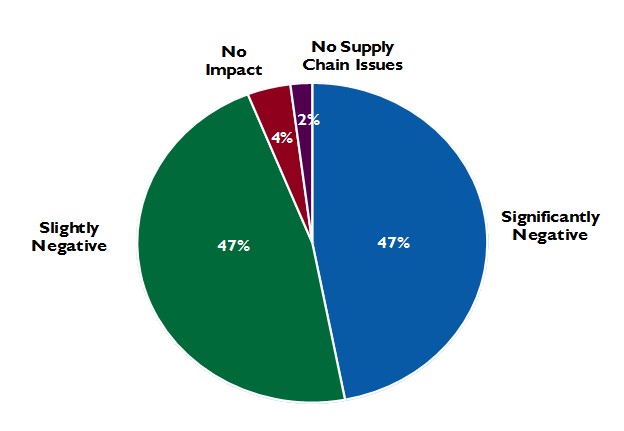

U.S. gas prices soared to an average of $5 per gallon in June,6 a result of the combined effects of the decrease in supply due to sanctions on Russia and issues with the supply chain. Despite the unprecedented costs, demand for the fuel has not decreased. The reliance of transportation on this fuel and the pent up demand to travel as a result of lockdowns from Covid-19 have bolstered the demand to withstand the tremendous increase in costs.7 Exploration and production firms are struggling to overcome supply chain issues and meet the unusually high demand for oil, with 94% of firms surveyed by the Federal Reserve Bank of Dallas reporting that supply chain issues were having a negative impact.5

Impact of Supply Chain Issues on Oil and Gas Firms4

U.S. oil and gas companies are not the only ones dealing with supply chain struggles associated with delays and shortages caused by the JIT model’s failure to adapt to recent global disruptions. Utility operators within the U.S. power industry have been forced to stock up and save their inventory of parts and equipment to address shortages of essential components such as the transformers that convert high voltage energy into energy used in homes.8

Recent initiatives to go green might have to be put on hold, as the renewable energy sector is facing similar supply chain issues. Copper, crucial to the infrastructure that transports renewable energy, as well as electric vehicles, solar and wind power, and energy storage batteries, is another material facing shortage issues. With an expected demand of 50 million metric tons and an annual supply shortage forecast to be 10 million metric tons by 2035,9 the idea of a JIT model that relies on quick, readily available copper for production seems difficult to continue for the copper dependent renewable energy sector.

Unfortunately, as with many aspects of pre-pandemic life, the relative stability in the global supply chain that industries enjoyed for many years is unlikely to be restored any time soon. Manufacturers and their suppliers must adapt to these new and continuing challenges. Companies will need to reevaluate many of their contracting and operations, including their approach to managing the risks inherent in pricing, warehousing/inventory and freight costs. Some companies may “reshore” production, so that their JIT models are less prone to supply problems.

Supply chains have thrived on the efficiency of the JIT supply chain model since its development in the 1970s. Within the energy sector, however, where the product is a necessity and delays and shortages are not an option, companies may have to consider changing their procedures and prepare for interruptions by storing inventory ahead of time. In this time of disruption and uncertainty, companies in all industries may have to sacrifice the efficiency of just-in-time for the safety of larger inventories.

Sources

(1) All Things Supply Chain, Is This the End of the Just-In-Time Supply Chain?, February 14, 2022.

(2) National Law Review, Flexible Strategies for Managing Uncertainty in Manufacturing Supply Chains, July 7, 2022.

(3) Federal Reserve Bank of New York, Global Supply Chain Pressure Index. August 31, 2022.

(4) Federal Reserve Bank of Dallas, Don’t Look to Oil Companies to Lower High Retail Gasoline Prices, May 10, 2022.

(5) Federal Reserve Bank of Dallas, Dallas Energy Fed Survey, June 23, 2022.

(6) Wall Street Journal, High Gas Prices Have Fuel Makers Raking in Cash, July 21, 2022.

(7) Federal Reserve Bank of Dallas, High Fuel Prices in the U.S. May Crimp Oil Demand Soon, June 21, 2022.

(8) Reuters, U.S. Power Companies Face Supply Chain Crisis this Summer, June 29, 2022.

(9) CNBC, A Coming Copper Shortage Could Derail the Energy Transition, Report Finds, July 14, 2022.

©Jordan Knauff & Company 2022