Hot Topics

The Rent Versus Buy Decision

By: G. Cook Jordan, Jr. and Lori A. Callaway

One of the most significant financial decisions most adults will make in their lifetime is whether to buy or rent a home. There are many components that factor into this decision, including economic and social concerns. When purchasing a home, buyers must consider various expenses, such as down payments, closing costs, maintenance, property taxes, and insurance. In contrast, renting typically involves a more straightforward monthly payment along with a security deposit.

Economic Factors

The state of the economy and the housing market have a large impact on the decision. The current combination of high home prices, elevated mortgage rates and low housing inventory creates a strong headwind for aspiring homeowners.

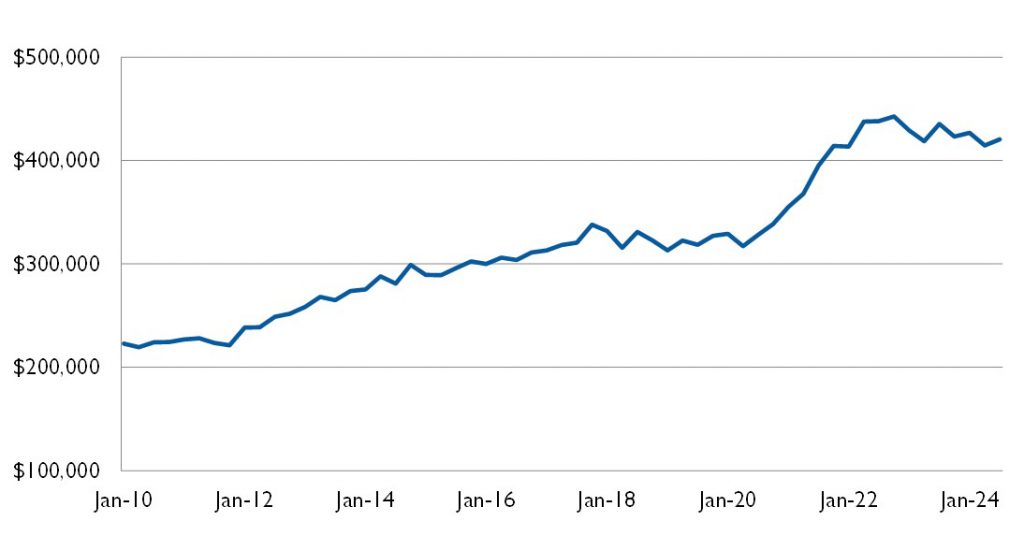

As of the third quarter of 2024, the average home price was $420,400 according to the Federal Reserve Bank of St. Louis. That is a 25% increase from the third quarter of 2020, when the median sales price was $337,500. From the first quarter of 2020 to the fourth quarter of 2022, the median home sales price rose 46%, among the fastest rate of median home sales price increases in U.S. history.1

| Median Sales Price of Houses Sold in the U.S.2 |

| Third Quarter 2024 |

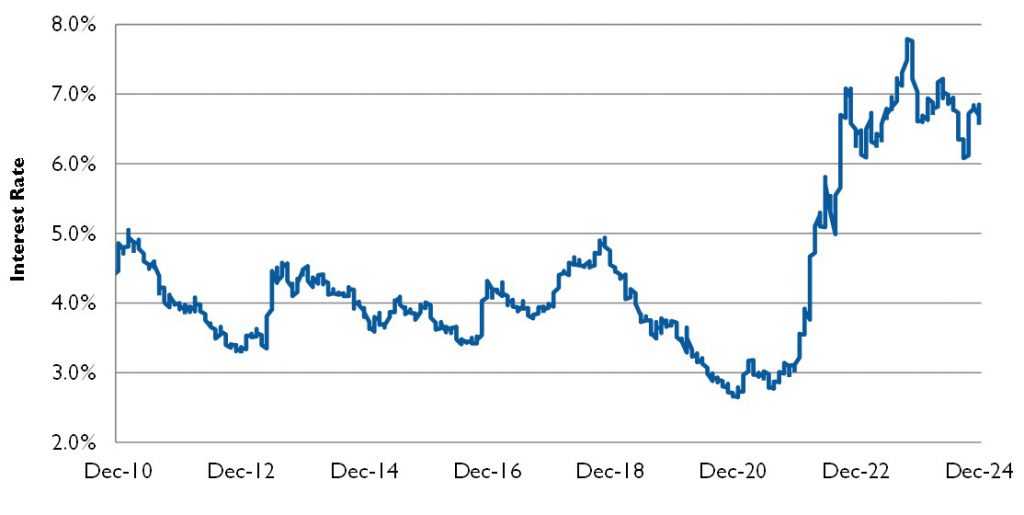

Mortgage rates fell significantly in 2020, driving up housing demand by buyers who wanted to take advantage of the lower rates. The COVID-19 pandemic also led to consumers shifting spending to housing and pushed more millennials toward homeownership. Starting in 2022, however, mortgage rates began to increase rapidly as the Federal Reserve Bank raised interest rates to combat inflation in the overall economy. Mortgage rates peaked at 7.79% at the end of October 2023. While interest rates for mortgages are down from their 2023 level, they are still relatively high compared to 2020. The national average for a 30-year mortgage was 6.85% at the end of 2024.

| 30-Year Fixed Rate Mortgage Average in the U.S.3 |

| December 2024 |

The U.S. housing shortage is essentially a problem of supply and demand. There is not enough housing supply to meet the demand of those who want to buy. The Great Recession, the pandemic, inflation, and elevated interest rates have all contributed to the shortage.

The Great Recession, which took place in 2007 and 2008, had a severe impact on housing inventory. New home builds were on the rise in 2005, peaking in January 2006 with more than 2.2 million housing units started that month (on an annual basis). Housing starts then declined sharply, hitting a low of 0.5 million in April 2009.4 The total number of new builds as of October 2024 reached 1.3 million on an annual basis, but homebuilding totals have yet to catch up to pre–Great Recession levels due to rising materials costs, supply chain issues, and labor shortages stemming from the pandemic.4

The U.S. has failed to keep up with the housing demands of a continually increasing population particularly when it comes to millennials, a huge demographic, who are now at prime homebuying age. Between 2012 and 2023, the average rate of household formation was 1.4 million households per year, while the average rate of housing starts was 1.2 million homes (including both single-family and multifamily) per year.5

The higher interest rate environment of the past few years has also added to the shortage. Many homeowners have mortgages with interest rates below 5%. These homeowners, who might otherwise be sellers, are simply choosing to stay in their houses due to their favorable mortgage rates, which is further limiting homes available for sale in today’s market.

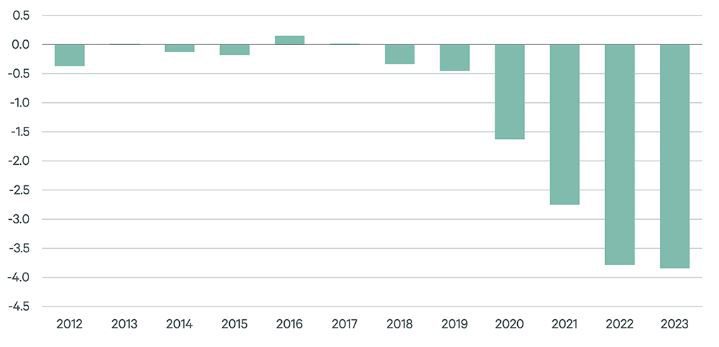

Real estate services firm CBRE estimates a shortage of 3.8 million housing units in the U.S., primarily in single-family homes and smaller multi-unit dwellings. These housing types account for approximately 90% of the overall shortage, which is expected to persist until at least 2029.6

| U.S. Housing Surplus/Shortage6 |

| Millions of Units |

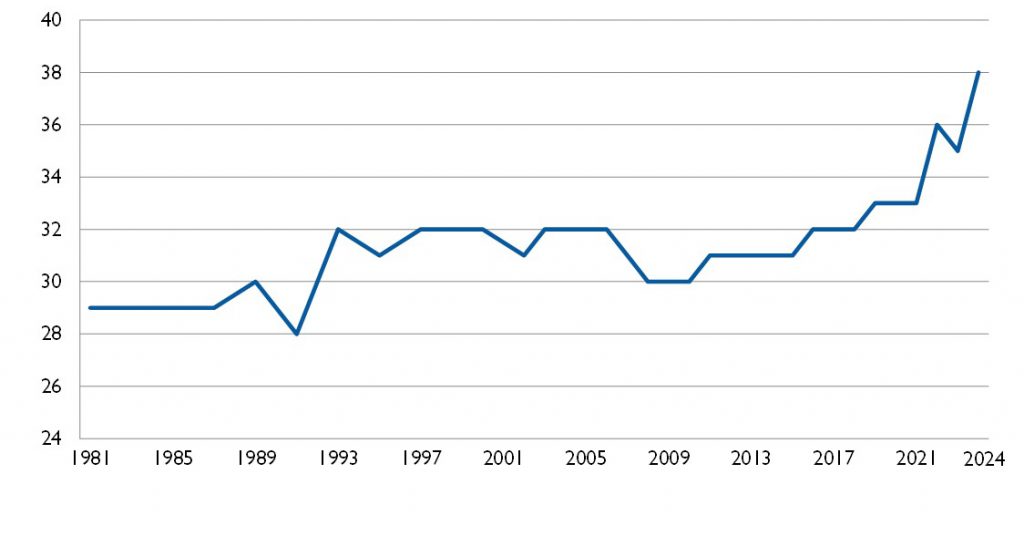

As a result of the above factors, first-time home buyers in the U.S. are getting older. The median first-time homebuyer reached an all-time high of 38 years old in 2024, three years older than in July 2023, according to the National Association of Realtors’ 2024 Profile of Home Buyers and Sellers report.7 In the 1980s, the typical first-time buyer was in their late 20s. Additionally, the share of first-time home buyers in the market decreased over the past year from 32% to 24%, the lowest since 1981.7

| Median Age of First-time Home Buyers8 |

| 1981 – 2024 |

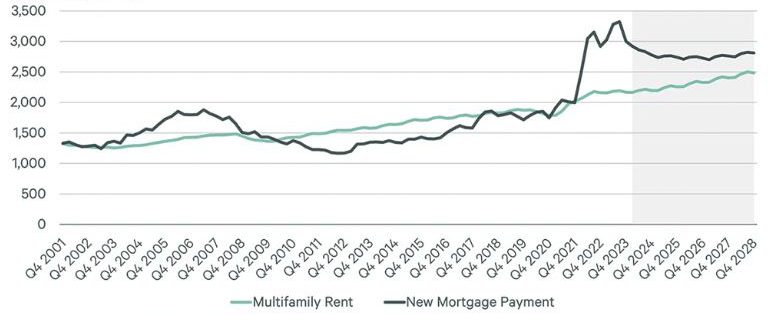

An analysis from CBRE found that, on average, mortgage payments were 38% higher than average apartment rents at the end of 2023,9 which has led more U.S. households to continue living in rentals instead of looking to buy a home. In 2021, the company’s data shows the average monthly multifamily rent and average new home mortgage payment were both around $2,000. By 2022, average mortgages reached approximately $3,200 per month, whereas average rents rose to around $2,200 per month.9 The largest divide came after 2022, when CBRE reports the average mortgage payment was nearly $3,400 and rent was still approximately $2,200. 9

Looking ahead, despite the current fluctuating market, CBRE estimates it will be at least five years until the two expenses become as closely aligned as they were before the steep increase in mortgage payments in 2022. CBRE expects 2.8% annual growth for multifamily rents over the next five years, in line with pre-pandemic trends.10 Given this modest growth, it would take a combination of falling home prices and lower mortgage rates to bring the cost of home ownership closer to that of renting.

By the end of 2024, CBRE predicts the average mortgage payment will be around $2,700 and stay around there until at least 2028. Meanwhile, it predicts the average multifamily rents will grow from $2,200 to $2,500 by 2028.9

| Average Monthly Multifamily Rent Versus |

| New Home Mortgage Payment6 |

| Monthly Payment ($) |

Many factors go into home and mortgage prices as well as rental costs in a specific city. Since location affects the likelihood of buying versus renting, it also affects pricing disparity. CBRE data shows markets like Dallas, Chicago, and Raleigh will likely see the gap return to pre-2021 levels within five years.10 Other large markets like Los Angeles, Austin, Seattle, Nashville, and the San Francisco Bay Area are expected to take longer.

Social Factors

In addition to the economic factors impacting the buy versus rent question, there are social factors and shifting priorities coming into play, including the fact that the percentage of young adults remaining single and the percentage of young adults not having children are both increasing.

The Institute for Family Studies projects that a third of today’s young adults will never marry compared to less than a fifth of those born in previous decades. As of 2023, just over half of Americans between the ages of 30 and 40 were married, down from more than two thirds in 1990.11

The share of childless adults under age 50 who say they are unlikely to ever become parents rose 10 percentage points between 2018 and 2023, from 37% to 47%, according to Pew Research Center. The Current Population Survey conducted by the U.S. Census Bureau shows the share of women between the ages of 30 and 40 who had ever given birth fell from 78% to 71% between 2012 and 2022.11

In conclusion, due to changing social values and current economic conditions, more individuals are forgoing traditional adulthood milestones such as marriage, homeownership, and parenthood. These trends reflect a move toward more flexible living arrangements for young adults and a move toward renting rather than buying.

Sources:

- Motley Fool Money, Average House Price by State in 2024, October 31, 2024.

- U.S. Census Bureau and U.S. Department of Housing and Urban Development.

- Freddie Mac.

- Bankrate, Why is housing supply so low? Understanding the U.S. housing shortage, October 17, 2024.

- Realtor.com, U.S. Housing Supply Gap Grows in 2023; Growth Outpaces Permits in Fast-Growing Sunbelt Metros, February 27, 2024.

- CBRE, Renting Will Likely Be Less Expensive Than Buying a Home for Some Time, March 18, 2024.

- CNBC, Average age of first-time homebuyers is 38, an all-time high, November 5, 2024.

- National Association of Realtors.

- Scripps News, Renting will be cheaper than buying a home for years, report finds, July 24, 2024.

- CBRE, New Mortgage Payments Expected to be Higher than Rent for Next Five Years, Making U.S. Homeownership a Challenge for Many, March 21, 2024.

- The Wall Street Journal, What Happens When a Whole Generation Never Grows Up?, December 31, 2024.