Articles

Why the Increased Interest in Industrial Outdoor Storage?

By: G. Cook Jordan, Jr. and Lori A. Callaway

The industrial outdoor storage (IOS) sector is becoming a focus of attention in the commercial real estate world. In June, Fortress Investment Group completed two industrial outdoor storage refinancings totaling $708 million with financing led by Deutsche Bank. Earlier in the year, Alterra Property Group raised $925 million for its U.S. and Canadian IOS fund, exceeding its original $750 million target. Alterra IOS is now approaching $2.5 billion in assets. Catalyst Investment Partners announced in April the final close of Catalyst IOS Fund II which was oversubscribed with $186.9 million in Limited Partner commitments. Fund II will grow the Catalyst IOS portfolio to over $500 million in gross asset value.

With an anticipated market size of $214 billion in 20231, IOS assets provide a critical connection point in the flow of goods and services and are an essential component of our industrial economy. IOS refers to industrial-zoned land primarily used for the storage of trucks, trailers, vans, large equipment, containers, and materials. IOS lots serve a mission-critical support role in the last-mile distribution of goods.

Retailers and logistics providers need space to transfer goods to trucks/vans, park unused vehicles, stow containers, and store equipment and materials that do not require indoor facilities. Importers and manufacturers need space to transfer finished products and store goods and materials. Other noteworthy uses for IOS include construction equipment and building materials such as lumber, plumbing, and roofing.

E-commerce Trend and IOS Market

There are a number of trends fueling interest in this segment of commercial real estate. Two of the more influential include e-commerce and manufacturing reshoring. One of the durable goods trends over the last decade, which is expected to continue driving industrial real estate demand, is the rapid growth of e-commerce. COVID pushed a segment of the population to shop online – a trend which is expected to create permanent user retention. Even though brick-and-mortar retailers have resumed normal operations after the pandemic, some consumers now prefer the ease of online shopping. Brands are also focusing on omnichannel strategies to reach customers both digitally and physically.

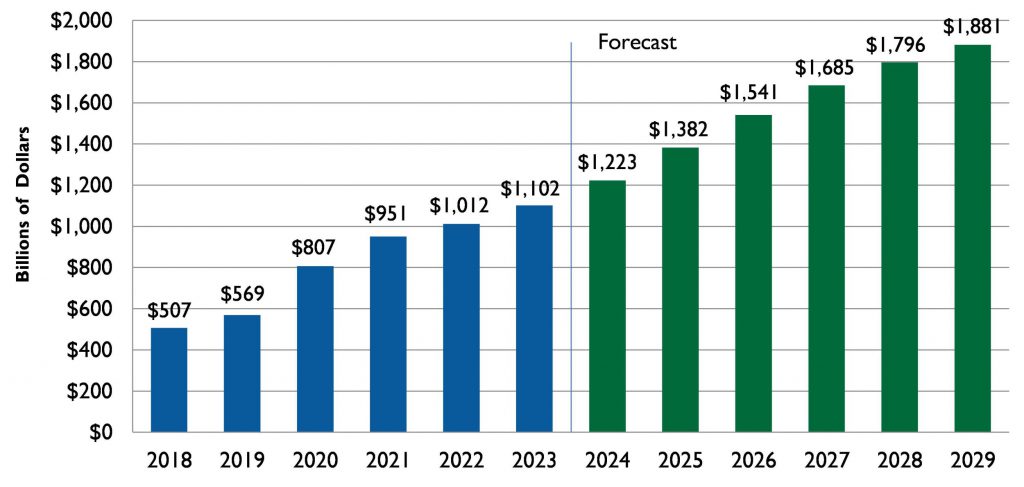

The U.S. Department of Commerce estimates that e-commerce sales for the second quarter of 2024 were $291.6 billion (seasonally adjusted), an increase of 1.3% over the first quarter of the year and 6.7% above second quarter 2023 sales.2 In 2023, U.S. e-commerce sales reached $1.1 trillion3, and are forecast to continuously increase between 2024 and 2029, reaching $1.88 trillion.4

U.S E-commerce Sales 2018 – 20293,4

In 2023, e-commerce comprised over 15.6% of total retail sales in the United States. Forecasts suggest that this proportion will continue to rise steadily in the coming years, reaching approximately 20.6% by 2027.5 E-commerce sales in the second quarter of 2024 accounted for 16% of total retail sales.2

In addition, e-commerce supply chains require a significant increase in total warehouse and logistics real estate space – on average three times larger – than a standard brick-and-mortar shop.6 A CBRE Research study found that for each incremental $1 billion in growth in e-commerce sales, there needs to be an additional 1.25 million square feet of distribution space to support the channel growth.6

Manufacturing Reshoring Trend and IOS Market

Interest in industrial outdoor storage facilities is also influenced by the increase in manufacturing reshoring. American companies of all sizes are rethinking their supply chains and manufacturing operations. The ongoing Russia-Ukraine war, rising tensions with common offshoring partners like China, and many other geopolitical factors are fueling these efforts. Organizations want to prioritize supply chain agility and promote business continuity so they can form more resilient and nimble supply networks. The rate of this reshoring has been accelerating over the last few years. Chief Executive magazine’s 2023 survey found that 58% of CEOs whose companies have had recent operations outside of the United States are now considering reshoring, with 18% exploring the repatriation of three-quarters or more of their operations.7 Assembly and parts manufacturing was the focus of reshoring for 68% of the respondents of the survey.7

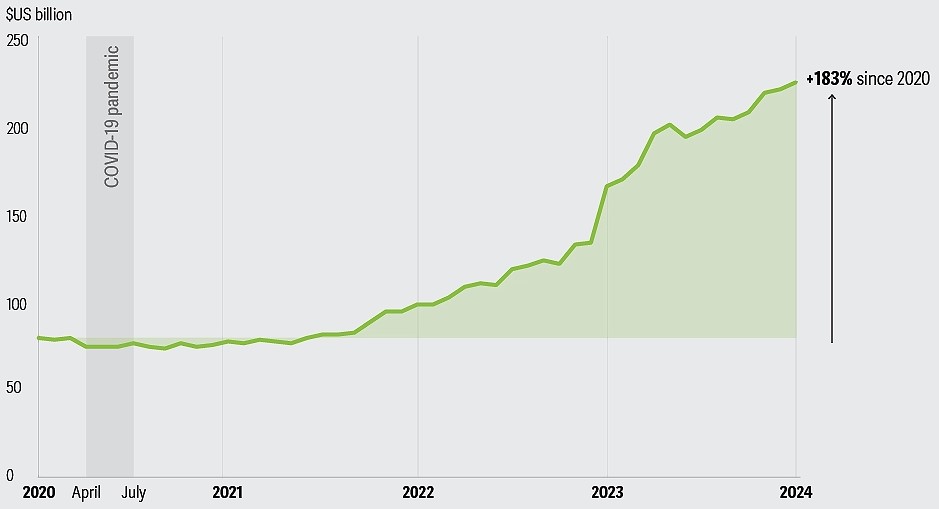

There are several recent economic indicators that reflect the U.S. reshoring surge. The number of manufacturing establishments in the United States grew by more than 11% between the first quarter of 2019 and the second quarter of 2023, approaching 393,000 by the end of the period.8 Construction spending in manufacturing – dollars invested to build new or expand existing manufacturing facilities – has nearly tripled since June 2020 and was up 37% year over year in January 2024 when it reached a record high of $225 billion.8

Total Construction Spending in Manufacturing8

U.S. industrial policies and subsidies have also driven the recent increase in reshoring. The Infrastructure Investment and Jobs Act (IIJA), the Inflation Reduction Act (IRA), and the Creating Helpful Incentives to Produce Semiconductors (CHIPS) Act projects represent over $430 billion to be invested in the U.S. and include announcements of more than 234,000 new manufacturing jobs to be created.8 This increased activity creates the need for more industrial warehouse space with manufacturers seeking locations that offer efficient warehousing solutions and proximity to transportation hubs, manufacturing centers, and key markets.

Other Factors in the IOS Market

IOS is a fragmented industry and is comprised of many “mom and pop” owners/investors. More than half of IOS sites in the U.S. are owned by “mom and pops” or users.9 Institutional capital has yet to dominate this subcategory of industrial real estate.

One of the challenges facing this niche sector is limited market data. Given the fragmented and noninstitutionalized nature of the business, historical and current data on IOS market rents is difficult to find. In addition, IOS demand and market rents are generally more volatile and sensitive to economic outlook than traditional industrial properties.9 For example, at the end of 2023, across many markets, on average IOS rental growth appeared to outperform overall industrial rent growth by approximately two times.10

Industrial outdoor storage areas serve as open-air repositories where companies can safely house their assets, ensuring they are easily accessible. As such, they play a pivotal role in enhancing the functionality and profitability of commercial businesses. By utilizing these outdoor storage spaces, businesses can optimize their operational efficiency, reduce the need for extensive indoor storage facilities and potentially lower overall operational costs.

Sources:

- IOS List, Anticipated Size of the Industrial Outdoor Storage Market: $214 Billion in 2023, November 11, 2023.

- U.S. Department of Commerce, Quarterly Retail E-commerce Sales 2nd Quarter 2024, August 19,2024.

- Oberlo.com, U.S. E-commerce Sales (2013-2023), U.S. Department of Commerce, Quarterly Retail E-commerce Sales.

- Statista, Revenue of the E-commerce Industry in the U.S. 2019-2029, July 12, 2024.

- Statista, E-commerce as Share of Total Retail Sales in the U.S. 2019-2027, February 6, 2024.

- CBRE, E-Commerce’s Impact on Industrial Real Estate Demand, 2021.

- Chief Executive Magazine, Reshoring Revolution: A Special Report, 2023

- Deloitte Research Center for Energy & Industrials, Taking Charge: Manufacturers Support Growth with Active Workforce Strategies, April 3, 2024.

- Green Street, Industrial Insights, Industrial Outdoor Storage: A Beautiful Ugly Duckling, April 11, 2023.

- Urban Land, The Rising Promise of Industrial Outdoor Storage, March 20, 2024.